What is a tax refund?

A tax refund is a procedure during which the tax office returns overpaid income tax to the taxpayer.

The overpayment can be due to various tax credits, deductions and excess advance payments collected by the employer during the tax year.

Who can receive a tax refund?

Tax refunds can be received by those who in the tax year:

- Worked and paid advance income tax.

- Made use of tax deductions, such as the child tax credit, rehabilitation tax credit, internet tax credit or thermal rehabilitation tax credit.

- They made deductions from income or tax, such as donations for public benefit purposes, health insurance premiums and housing expenses.

How to get a tax refund?

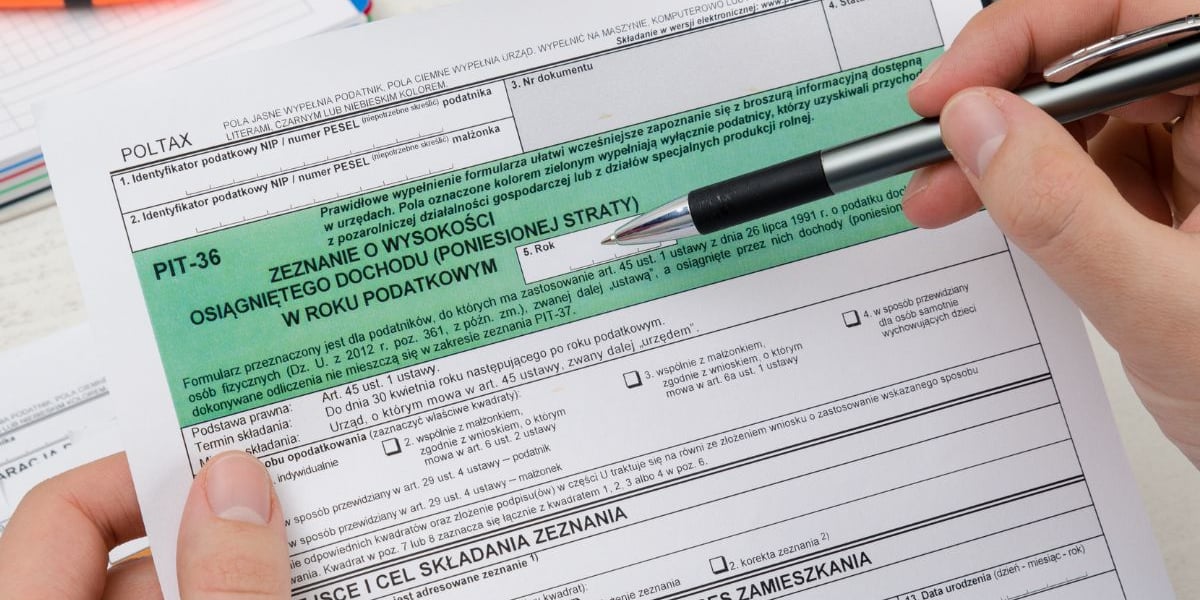

- Filing an annual tax return:

- The basic step is to file an annual tax return (PIT) with the relevant tax authority. The most common forms are PIT-37 (for those employed under a contract of employment) and PIT-36 (for self-employed persons).

- Tax returns can be filed in person at the tax office, sent by mail or electronically via the e-Deklaracje system or Your e-PIT service.

- Showing overpayment:

- The tax return must correctly show all income and the allowances and deductions to which you are entitled.

- An overpayment of tax is the difference between the tax due and the sum of advance payments collected during the year and deductions.

- Deadline for filing the return:

- Tax returns must be filed by April 30 of the year following the tax year.

What tax credits and deductions can affect the tax refund?

- Child Tax Credit: Benefit parents or legal guardians raising children.

- Rehabilitation tax credit: For people with disabilities or caregivers of people with disabilities.

- Internet tax credit: Deductible for internet usage expenses.

- Thermal modernization tax credit: For owners of single-family homes who have incurred expenses for thermal modernization work.

- Donation deductions: For public benefit, religious worship or blood donation.

- Health and social security contributions: Deduction from income or tax.

When is the tax refund due?

- Refund deadline: The tax office has 45 days to refund the tax, counting from the date the return was submitted electronically, or 3 months if the return was submitted on paper.

- Form of refund: The refund can be made by transfer to the taxpayer's bank account or by postal money order.

What to do if the refund is not made on time?

- If the tax refund is not received by the statutory deadline, the taxpayer should contact the tax office to explain the reason for the delay.

- A complaint or a complaint about the lengthiness of the procedure can also be filed.

Learn How to File PIT (Personal Income Tax) in Poland. Step by step: here